Georgism & Freiland Crash Course

Understanding Natural Resource Taxation

1. What Is Georgism?

1.1. Why Is Georgism Worth Trying?

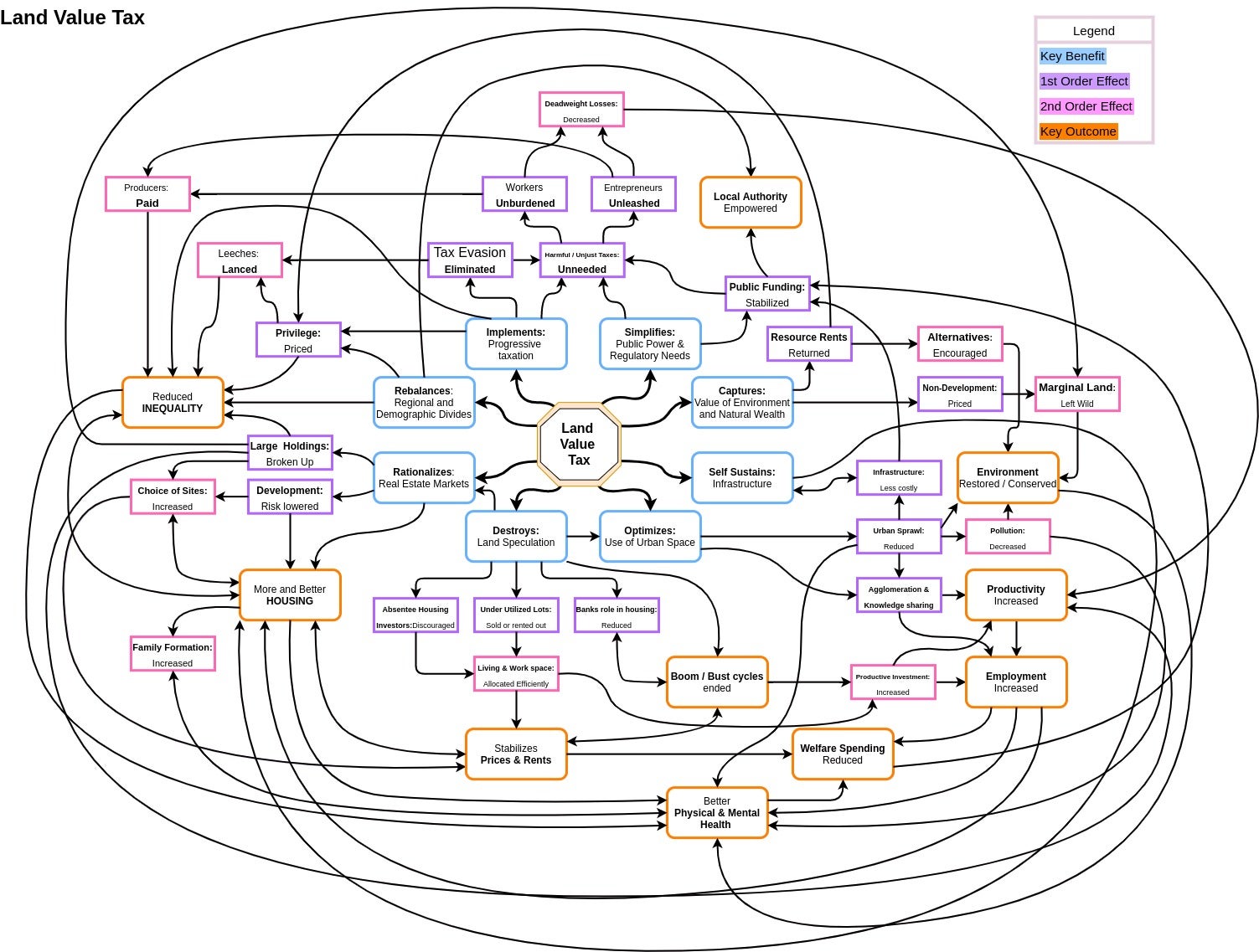

Georgism[1] is the position that income tax, sales tax, property tax, and all other taxes should be abolished and replaced with taxes on natural resources (NRT) and land values, which would fund all government services. The idea is that society would greatly benefit from overhauling the taxation system:

- Goods and services would become cheaper (due to abolishing sales taxes).

- Employees would command higher wages by getting to keep more of their labor (due to abolishing income taxes).

- Employers would be able to buy more labor for less money (due to abolishing income taxes).

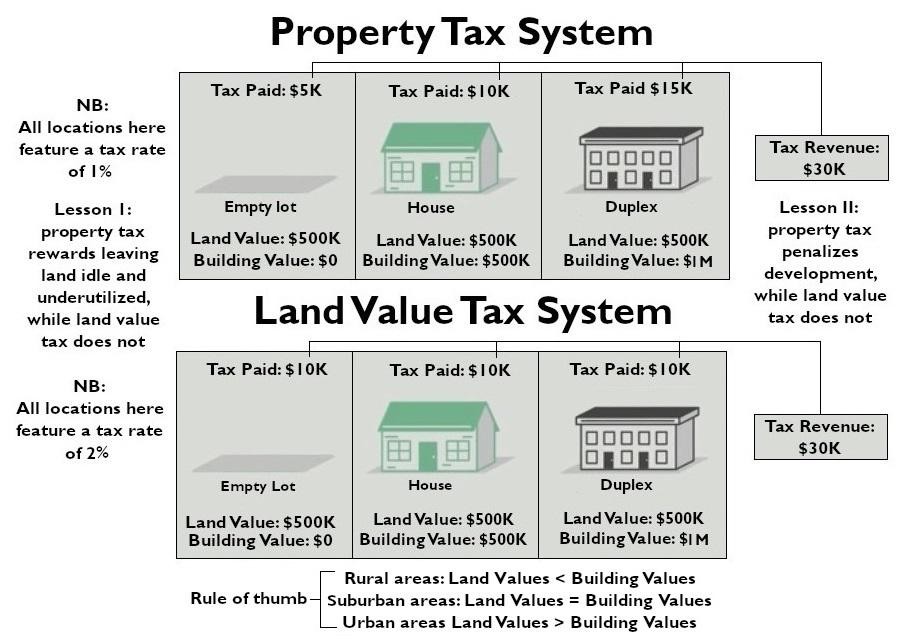

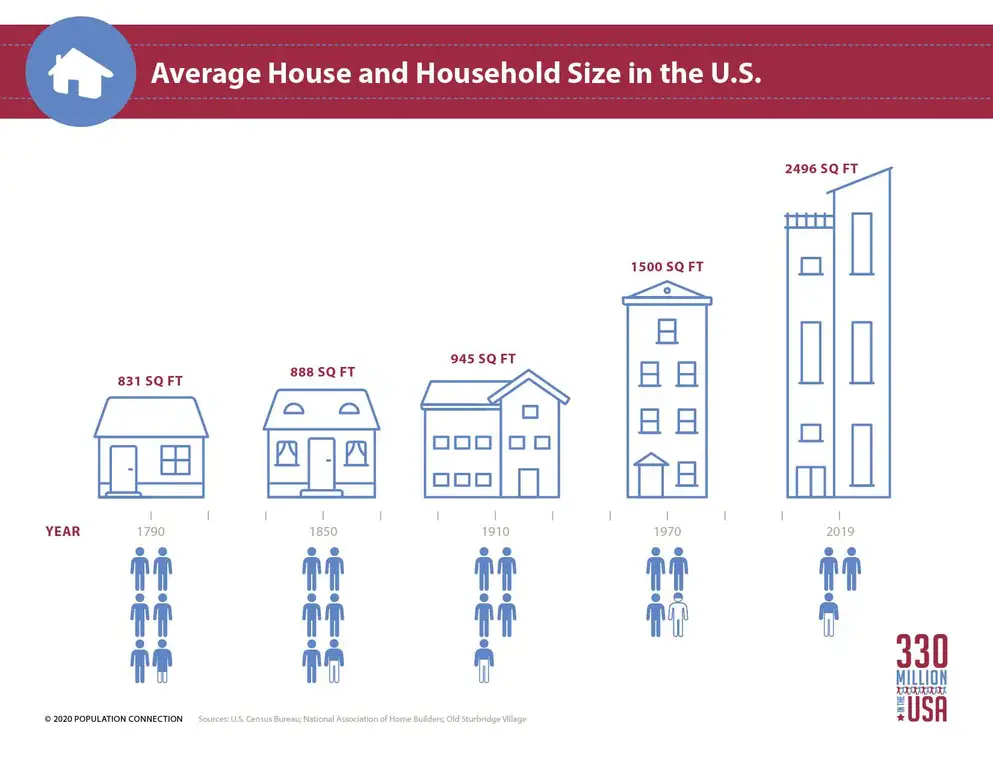

- Housing would be more affordable (due to abolishing property taxes & landlords being incentivized to build more housing per acre).

- People who own buildings wouldn’t be disincentivized to not upgrade them anymore. If property taxes are abolished, then people won’t get penalized for renovating their properties.

- The economic inputs of the economy would get taxed instead of the economic outputs, so there would be incentives to use the inputs (Land & Natural Resources) more efficiently. This is important because there is a finite amount of valuable land and natural resources on Earth. We want to avoid resource degradation. Natural resource taxation also wouldn’t penalize people for generating greater economic outputs, unlike the current taxation system.

- NRT would increase economic stability by bootstrapping the entire economy to the prices of its economic inputs. Economic instability is built into the current system since the prices of the economic outputs of the economy depend on an endless circle of other economic outputs that is ultimately grounded by a combination of resource extraction fees, regulations, licenses, taxes, government fiat, etc. Markets generate prices, but they generate them from other prices too, which are ultimately determined by the prices of the economy’s inputs to production.

- Urban sprawl would be non-existent (by eliminating land speculation and encouraging urban space to be optimized).

- Private land monopolies wouldn’t exist anymore.

- Pollution would be disincentivized. Pollution taxes are a logical conclusion from recognizing that land belongs to everyone equally.[2]

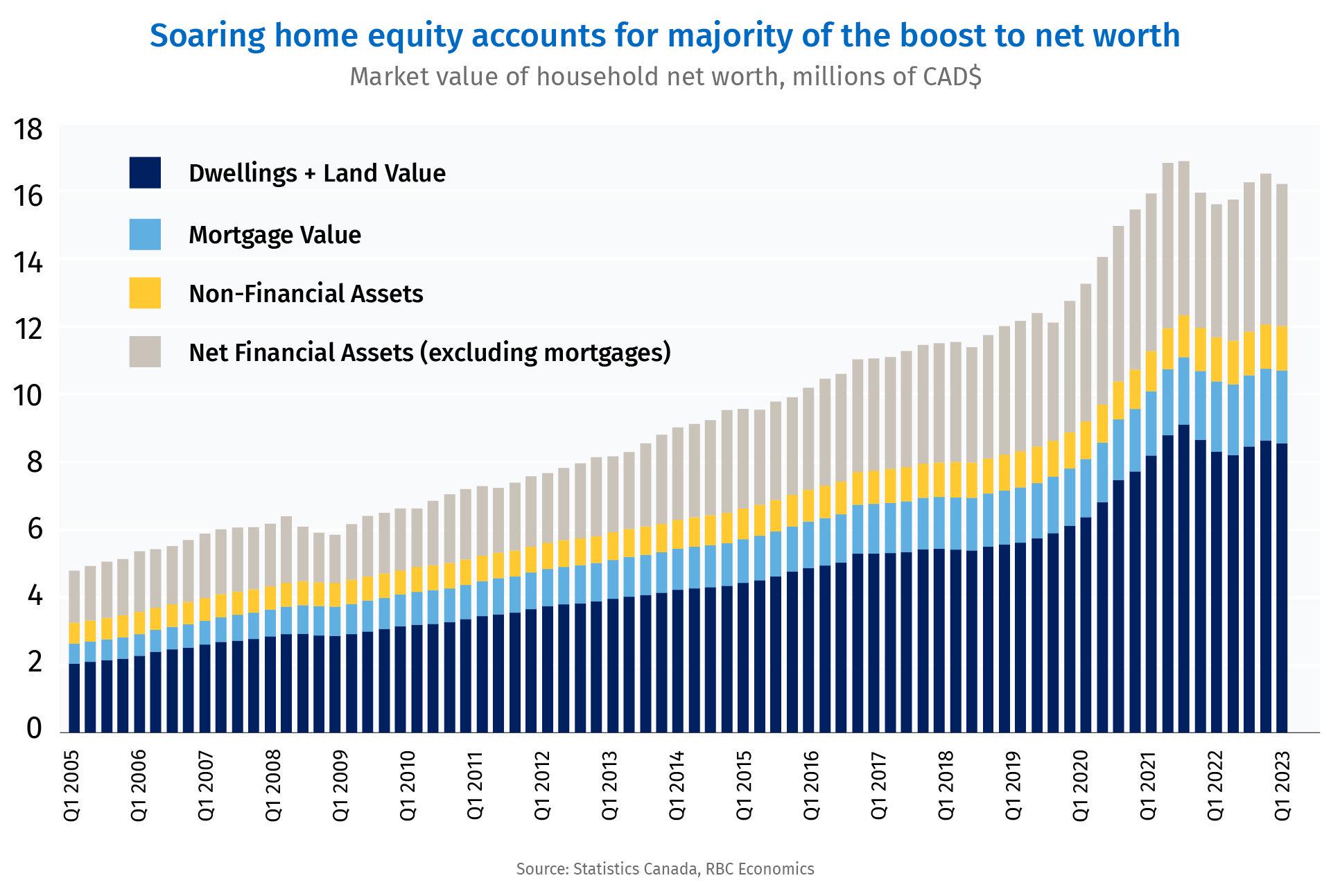

- Since the wealthiest people are naturally the ones who own the most land and the most valuable land, Land Value Tax would reduce economic inequality, because the LVT would mostly fall on the wealthiest members of society.[3]

- Not only does land value tax tend to fall on the wealthy, but it is also the best tax to place on the wealthy because land cannot leave the country. Even if the possessors of the most valuable land gave up their land and left the country, whoever ends up becoming the new possessors of the land would become the new title holder who has to pay the land value tax. We can be certain that someone will definitely take the land title and pay the LVT if the land is as valuable as it is.

- It is extremely difficult to do tax evasion under LVT, since land cannot be concealed or moved overseas. Land titles are also easily identified, since they are registered with the public. Land value assessments are usually considered public information, which is available upon request. This transparency reduces tax evasion.

- A person who claims land can occupy it as long as they pay the appropriate Land Value Tax for the land that they’re occupying. This resolves Tragedies of the Commons, while simultaneously ensuring that everybody benefits from it, not just the one single person who is occupying the land. This is a win-win, unlike Communism where there is the Tragedy of the Commons (ToC), or Anarcho-Capitalism where there is no ToC, but property owners get unfairly wealthy for value that they did not create.

- When everybody owns land equally,[2] this ensures that everybody has equal access to the three factors of production: Land, Labor, and Capital. It follows that economic productivity is increased, and wealth inequality is dramatically reduced. The massive wealth inequality that exists today is in large part caused by the skewed and unequal ownership of highly valuable land.

- Replacing all the inefficient forms of taxation with NRT would lead to a simplified tax code that makes taxes straight-forward and easy to file. This would eliminate all the wasteful economic activity that is spent each year looking for tax loopholes, deductions, and lobbying.

- Real estate bubbles and recessions won’t be possible anymore if land is taxed at 100% of its value. The world would be so much better off if Japan’s Lost Decade, the Great Recession, and China’s upcoming real estate bubble and recession never happened. Also note that land speculation is undesirable for all human societies since it is a form of rent-seeking.

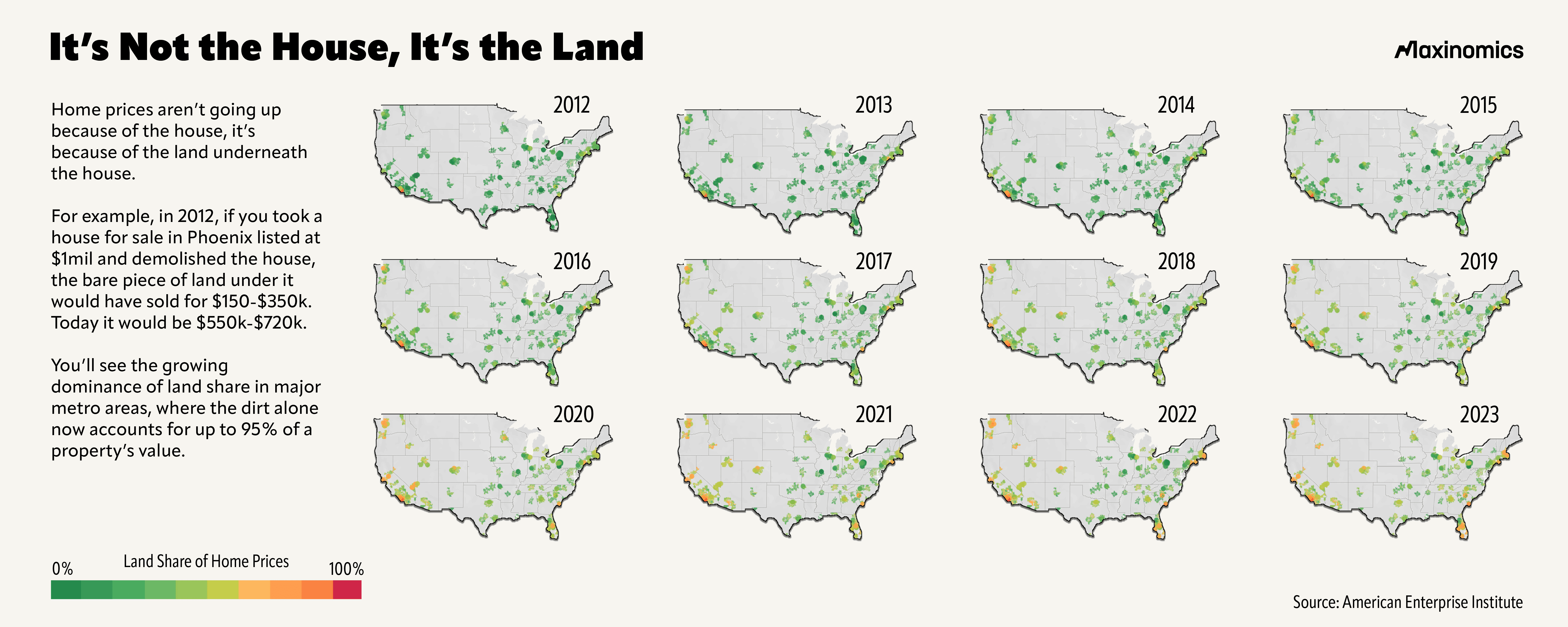

- Cities that use pro-Georgist urban planning would have no need for cars and no need to save up as much money to buy houses or pay rent. For most houses, most of the value is concentrated within the land that the house sits on, not the actual house itself. By eliminating the need to buy two of the most expensive items that people will ever buy within their lifetimes, the economy becomes drastically more efficient because all the money being used to buy those expensive things (houses and cars) can now be used to buy more important things instead.

Historically, Georgism used to have millions of followers, until it gradually lost its popularity over the 1900s due to a succession of many unfortunate events. As the linked essay explains, the reasons for why this happened have nothing to do with the rationality nor the feasibility of Georgism.

1.2. The Georgist Theory of Property Versus the OATP

The Georgist Theory of Property (GTP) can be stated using the following reasoning:

- Every person owns themself.

- Every person thus owns the labor that they produce.

- Every person thus owns anything produced by the combination of their labor and their capital.

- People can trade things created with their labor for things that other people created with their labor.

- Land is not created by labor.

- But land is necessary in order to be productive (because it’s one of the three factors of production: land, labor, and capital).

- For everybody to have an equal right to be productive,[4] everybody must have an equal right to land.

- In order to have a free-market economy, everybody must have an equal right to be productive,[4] otherwise the economy is anti-free-market.

Conclusion: In order to have a truly free-market economy, everybody must have an equal right to land. Likewise, no one should have unchecked ownership of land because they did not create the land, lest the economy be anti-free-market.

By contrast, the Original Appropriation Theory of Property (OATP) is a finder’s keepers approach to property rights. The OATP is the current theory of property in use by most modern societies. It is the main culprit behind real-estate recessions, the ever-increasing cost of housing, inefficient urban planning, increased pollution, and so much more.

The only perspective from which the OATP could be considered “better” than the GTP is from people who already have power and want to maintain their existing power structures. This is indeed the main reason why the world has not adopted the GTP. Power is self-justifying. And then there’s the fact that most people don’t have good economic intuitions for understanding how a Georgism-like system would be more economically efficient for everybody overall.

Read More: The GTP Versus OATP From A Libertarian Perspective.

1.3. Georgism Compared to Other Economic Ideologies

Unlike Capitalism, Socialism, and Communism, Georgism has never been tried before. Georgism is unique for being the only economic system where everybody is guaranteed equal access to all Three of the Factors of Production.

The following table shows how Georgism compares to more widely known economic ideologies, based on whether each of the Three Factors of Production is private or public.

| Capitalism | Georgism | Socialism | Communism | |

|---|---|---|---|---|

| Land | Private | Public | Public | Public |

| Capital | Private | Private | Public | Public |

| Labor | Private | Private | Private | Public |

The following sayings are often associated with each Factor of Production being “public”:

- “Land should be public” = “Everybody should have equal access to Land”.

- “Capital should be public” = “Seize the means of production”.

- “Labor should be public” = “From each according to his ability, to each according to his needs”.

Basically, the distinction between whether each factor of production is public or private is whether it is owned by the state or owned by individual entities.

1.4. Why Everybody Owns Land Equally

But if a landowner has to pay taxes on their land, then they don’t truly own it.

Correct, they don’t truly own it. The rightful owners of the Earth’s land is (collectively) everybody:

- If someone steals something and sells it to someone else, then the transaction is not valid, because people cannot trade things that they don’t legally own.

- If stolen property is used within a transaction, then the transaction is invalid, and the property has to be returned to the original owner.

- Claiming land that is already owned by someone else is invalid. Settling it is tantamount to stealing it.

- Before any of the Earth’s land was ever privately owned by anybody, land was not owned by anybody, which is essentially the same as everybody owning the Earth’s land equally.

- Everybody was therefore the original owners of the Earth’s land.

- All current landowners acquired their land by either: stealing it, settling it, inheriting it, or buying it.

- Land that was bought or inherited was originally possessed by someone who stole, settled, inherited, or bought it.

- All privately owned land was either settled or stolen at some point, by [6] and [7].

- All settled land was stolen at some point, by [5] and [3].

- If land was initially stolen, and passed onto its current owners through a combination of settlement, theft, inheritance and trade, then none of those transactions were valid because stolen property was used in the transactions, as established in [1] and [2].

- All privately owned land was stolen at some point in human history.

- All privately owned land should therefore be returned to its original owners: Everybody.

Occupying land prevents other people from using it. If land is owned equally, then a person who fences off land to prevent other people from using it (without giving due compensation) is effectively stealing that land from the commons. Most people have no solutions for resolving this injustice, whereas Georgists have a clear solution. Georgists propose that people can privately possess land, as long as they pay compensation to the original owners, in the form of taxes on land value and natural resources.

|

|

|

|

1.5. Addressing Objections to Equal Land Ownership

But if everybody owns land equally, isn’t that the same thing as nobody owning any land at all?

Technically yes, but that does not constitute an argument against equitable land ownership. Georgism still solves the Tragedy of the Commons with respect to land because Georgism explicitly allows private possession of land.

Why is everybody owns land equally the same thing as nobody owning any land at all?

Because there’s nothing to differentiate the two. The Raven Paradox is relevant to this discussion here. Information is created by recognizing differences and patterns.

Alternatively, if we argue that there is no “original owner” for land, then the land was simply there then some guy decided it magically became his and he decided to use force to defend it from others.

But all things are made of natural resources. So, if an individual can’t own natural resources to begin with, then they can’t own anything that’s produced using the natural resources.

Every person owns the labor that they produce. Picking an apple from a tree is “buying” the apple in a sense, with one’s labor. Collecting sticks to build a fire is the acquisition of land via one’s labor. So, is building a shelter, tools, etc. Even if an individual doesn’t own any natural resources to begin with, they could always trade their labor for natural resources.

Moreover, Georgists have no problem with people claiming land, if there is plenty of land available for everyone. The game theory problems and the necessity of taxing land to solve those problems only start when more people want land than there is land available (see: visual infographics). Hence, we’re always guaranteed that some people would already be owning some natural resources (or products created with natural resources) before there would ever be any need for a society to tax natural resources.

But if all the world’s land is already claimed, and late-comers can make claims to land, there will be irresolvable conflicts. The OATP is the only fair way to resolve land ownership.

This is not true. In fact, OATP proponents would argue that if people have to pay taxes on their land, then they don’t truly own all of it because the government would be owning part of their land. (And they have to, because otherwise there’s no way for most people to feasibly protect their property rights.) Since Georgism achieves equal land ownership by collecting land rents and redistributing the value to everybody else, it’s perfectly possible for first-comers and late-comers to own land equally, without all the wealth inequality that the OATP causes.

1.6. Property Rights Are Not Indivisible

Many people fail to realize that property rights and “ownership” are not some simple, natural, and indivisible thing. Rights are intersubjective, and they are created by society. Property rights don’t consist of a single right, but rather a collection of legal rights, including:

- The right to use (usus).

- The right to profit (fructus).

- The right to exclude.

- The right to transfer.

- The right to modify.

- …and several others.

There have been many systems of ownership throughout history which use a different set of rights to define property. Even within free-market systems, almost all of these rights are limited or subverted in various ways. In this respect, Georgism is no different.

2. Visual Diagrams For Understanding Georgism

2.1. Supply-Demand Curves For Understanding NRT/LVT

The following links show some interactive graphs, charts, numbers for modeling how the mathematics and economics of Georgism work.

- Geogebra: The Law of Rent.

- Geogebra: Distribution of Wealth Between Factors of Production.

- Geogebra: Land Value Tax Calculator.

- Geogebra: Land Value Tax Revenues Relative to Rent and Land Value.

- Geogebra: Idle Land, Unemployed Workers Caused by Incorrect Taxation.

Figure 1: Perfectly Inelastic Supply, CC BY-SA 4.0, by Explodicle.

Figure 2: Maximum Taxation With Perfectly Inelastic Supply, CC BY-SA 4.0, by Explodicle.

Figures 1 and 2 differ from the original images since the transparent backgrounds in the original images was replaced with solid white backgrounds.

2.2. Why Georgism Would Make Housing More Affordable

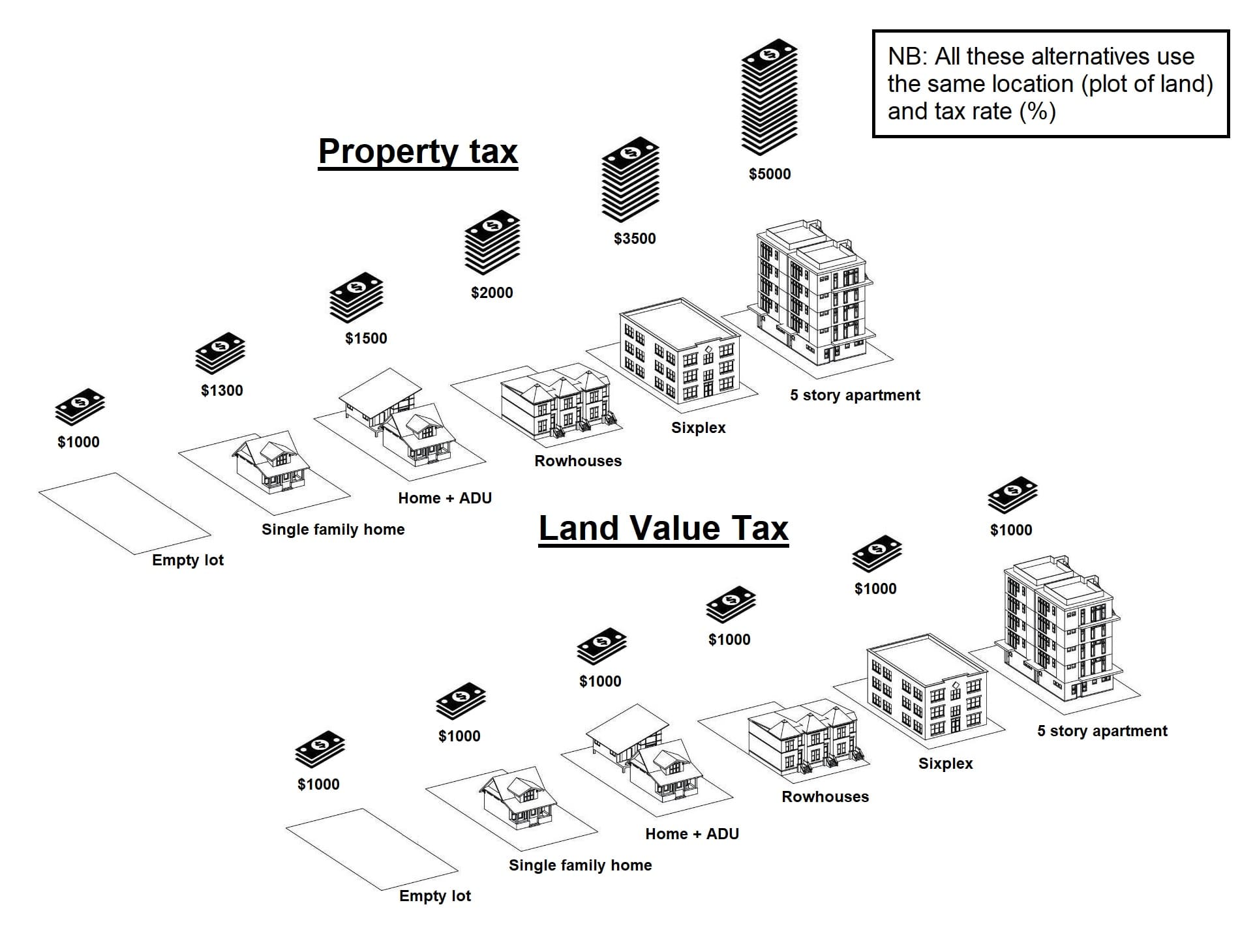

Since LVT would make landlords pay the same amount of tax no matter how much or how little housing they build on the same plot of land, LVT would encourage landlords to build more housing. This would make housing more affordable everywhere, whereas property taxes make housing more expensive by punishing landlords who choose to build more housing and punishing people who renovate their properties.

The diagram below helps explain why LVT cannot get passed onto the tenants, whereas property taxes can. Since LVT would increase competition in the housing market by incentivizing landlords to build more housing, housing prices would decrease, while the tax rates stay the same (unless the value of the land changes).

|

|

Relevant Video: How to be a Landlord 101: Being A Landlord Gives You The Right To One-Third Of A Household’s Income.

Relevant Video: How to be a Landlord 201.

Read More: So You Want to Abolish Property Taxes – Lars Doucet.

Read More: What happens when America’s Monopoly board fills up? – Progress & Poverty Substack.

2.3. Visualizing The Effects Of Natural Resource Taxes

Different versions of the graph above are shown in the following links:

2.4. Ricardo’s Law, Land Speculation, Mortgage Debt, and Lending

Land Economics Part I: Ricardo’s Law of Ground Rent (Downloadable Infographic)

Laying out the foundational economic theory behind Georgism, and illustrating how unequal land distribution helps depress wages.

Land Economics Part II: Speculation and Idle Land (Downloadable Infographic)

Government Policies Enable Rent-Seeking, Untold Economic Inefficiency, and Lower Living Standards.

Land Economics Part III: Mortgage Debt and Lending (Downloadable Infographic)

How Land Speculation, Mortgages, and Banks Cause Real Estate Bubbles and Recessions.

Desert Island Economics - Existential Comics

This comicstrip demonstrates how the OATP and private land ownership (and land monopolies) cause wages to fall to subsistence.

2.5. The Geo-Austrian Theory On The Boom And Bust Cycle

This video gives a good introduction to the Austrian School of Economics.

The boom and bust cycle is mainly caused by land speculation. It is visually illustrated in this infographic (the third in a three-part series on Georgism). It works as follows:

- The Fed manipulates rates below the natural rate to artificially boost growth with cheap credit.

- Loose monetary policy combined with boosted growth causes inflation.

- The Fed is forced to raise rates to put downward pressure on prices.

- Investment in high-order capital goods like housing slows as rates rise.

- Mortgages become more expensive.

- Demand for homes falls.

- Construction slows down in other sectors of the economy as investments turn bad.

- Banks toughen lending rules as growth in property prices slows.

- Demand falls further and supply begins to increase.

- Uncertainty in the real estate market causes a credit crunch for homeowners.

- The credit crunch extends to asset-backed commercial paper.

- A reduction in the supply of loanable funds raises rates further, significantly discounting future cash flows and corporate profits.

- Homeowners with adjustable mortgages begin to default.

- Supply increases further and home prices start to fall significantly.

- The stock market crashes.

It is said that a real estate bubble causes an economic depression every 18 years on average. The last one happened in 2008, so that would place the next depression for ~2026, but our ability to accurately predict the exact year has been thrown off due to the economic aftermath of the coronavirus lockdowns.

Also see: Wikipedia: Demurrage Currency for a more complete theory on the boom and bust cycle.

NOTE: The Geo-Austrian Boom and Bust Cycle Theory still doesn’t fully explain why booms and busts happen. Silvio Gesell’s monetary theory would have be accompanied as well in order to have a complete theory on boom and bust cycle. There’s more to be said about how traditional money causes recessions and an artificial lack of capital investment. For now, see: Demurrage Currency FAQs.

3. Freiland, Freiwirtschaft, and Silvio Gesell

3.1. What is Freiland?

Freiland (German for “free land”) is an economic theory and proposal founded by the German-Argentine economist Silvio Gesell in his 1916 book, The Natural Economic Order as a component of his proposed Freiwirtschaft economic system.

Freiland was inspired by Georgism. Gesell agreed that private property is harmful to economic prosperity. However, he disagreed with Henry George that land value taxes could solve the problem of land rent, as he believed that the taxes could be passed onto the tenants.

Instead, Gesell proposed that public ownership of land should be accomplished by making the government purchase all land from current landowners through a massive amount of government land bonds, which would be paid over in 20 years by leasing the land through a system of competitive bidding for leases.

Most Georgists are currently unaware of Silvio Gesell, his Freiwirtschaft economic theories, and Freiland. Georgism is more well known in the Anglosphere, whereas Freiland is more well known in the German-speaking and Spanish-speaking worlds. There are major language barriers between the familiarity of the two economic theories.

Since Freiland has many differences to Georgism regarding its implementation and effects, my recommendation is that we should raise awareness about both systems and create more discussion and real-world experiments to test how the two systems compare to each other. Both systems would theoretically accomplish the same goal, but one may prove to be better than the other regarding ease of implementation and/or maximizing economic prosperity.

3.2. Freiland Versus Georgism

Freiland would achieve many of the intended effects of Georgism. Despite their aims and similarities, they have many important differences regarding their implementation and effects:

- Freiland would compensate previous landowners through bond payments, whereas Georgism doesn’t compensate landowners at all.

- Gesell proposed that the land bonds and leasings under Freiland would be implemented under local governments, whereas the land value taxes of Georgism could be collected on a local or national level.

- Both systems would likely require gradual transitions before all land becomes publicly owned. Freiland would completely abolish private land ownership outright, since the government would gain complete ownership of the land after buying it through land bonds. By contrast, Georgism would have a more gradual transition for phasing out land ownership until 100% of the value of land is de facto owned by the government.

- It might be faster to transition to the Freiland system compared to Georgism, since it would transfer ownership of all land to the government overnight via compulsory person purchase.

- While landowners would have to be compensated, the government would be able to start leasing all land at 100% of its value through the comparative leasing system, which means that land would be leased from the government at 100% of its value immediately, which would greatly increase the amount of revenue that the government can get from leasing land out of private entities.

- For a while, this revenue would go towards paying back the land bonds to compensate the previous landowners, but the immediate the ability to immediately lease land at 100% value with share a ton of revenue, which could be used for other things, especially if the bomb payments are extended by say 30 years ago or something.

- In fact, it may even be better to extend the bond payments out to 30 years instead of 20 years, because if the previous landowners die, then they would no longer have to be compensated, because that’s how most bonds work.

- Since Freiwirtschaft would require completely ending private land ownership, the value of improvements to land would have to be completely separated from the value of the land itself, when the amount of bond payments for purchasing the land from existing landowners is decided. This could make legal matters pertaining to the ownership of improvements to land more complicated, in comparison to Georgism.

- Under Freiland, it would not be necessary to repeatedly re-appraise the value of land. Land would only have to be appraised when the government decides how much land is worth for acquiring via eminent domain.

- Freiland would use a competitive auction system for determining who gets to occupy land parcels, which is arguably less vulnerable to corruption and may be more similar to a free-market system.

- Land value taxation might be easier regarding the implementation. Property taxes could be gradually replaced by land value taxes. By contrast, the consequences of the land bonds system may be less uncertain since it’s never been tried before on such a massive scale.

- The Georgism system may provide land possessors greater incentives to take good care of the land, compared to the Freiland land leasing system.

- It’s debatable which one would be easier for gaining public support.

- Georgism is arguably easier to implement, and Georgism would appeal more to people who don’t already own land.

- By contrast, Freiland might be more popular among current landowners and homeowners, since 100% of the value of all their land holdings would be compensated through bond payments.

- Freiland may thus have stronger appeal in areas and countries that have higher homeownership rates.

- Under both systems, it’s possible to eventually abolish all taxes, until the only taxes paid are through land value taxes or land leasing.

3.3. Freiwirtschaft And Demurrage Currency

While this webpage is mainly about land economics and taxation, I also encourage readers to read about demurrage currency and monetary economics. Ideally, demurrage currency should be paired with land reform for an optimal economic system.

More information:

4. The Space Utility Optimization Principle

Formal Statement of the Space Utility Optimization Principle (SUOP):

“When the optimized arrangement of a collection of objects in 2D or 3D space maximizes the (collective) value or utility that people derive from that space’s optimized arrangement.”

The derived value from the arrangement of objects within a space can be:

- Psychological value from the perspective of a single person (e.g. the arrangement of keys on a keyboard, FILO and LIFO storage arrangements, etc).

- Social value from the perspective of a society (e.g. urban planning, memory allocation in computer systems, etc).

- Biological value when dealing with the arrangement of organs, tissues, cells, cellular structures, etc within an organism.

With regards to applying the SUOP, some of these phenomena revolve around the most efficient arrangement of system components in a given 2D or 3D space:

- Land Distribution.

- Urban Planning. The most important buildings and areas should be located near the city center.

- Memory Allocation (malloc). The arrangement and allocation of memory in a computer affects the computer’s performance.

- The arrangement of components on a circuit board is important.

The various versions of the Raspberry Pi have their current circuit board configurations because they were the most effective for its design.

- Similarly, adding more memory to the Ergodox EZ would require upgrading the processor, which would require changing the entire circuit board. Small changes have big effects on determining what the most optimal space arrangements are.

- LIFO and FILO storage (physical).

- LIFO and FILO data structures.

- The arrangement and layout of GUIs.

- The keys on the keyboard, Qwerty vs Colemak, the positions of caps lock vs backspace, etc.

- Mathematical Optimization.

- If the arrangement of organs inside of an organism were different, the various organ systems of the body would work less efficiently, perhaps even ceasing to function correctly at all.

The SUOP is useful for thinking about Spatial Economics and Economic Location Models.

If the human brain had a vastly different arrangement of all the neurological components that make it up, it probably wouldn’t work as well as it does in most cases. Examples:

- The occipital lobe that controls vision is located in the back of the brain instead of the front. I hypothesize that this is done to increase the number of connections with the rest of the brain.

- The left hemisphere of the brain controls the right side of the body, and the right hemisphere of the brain controls the left side of the body. Similarly to the occipital lobe, I hypothesize that this is also done to increase the number of connections of these hemispheres with the rest of the brain, compared to if the same side of the brain controlled the same side of the body.

- The most important functions of the brain (the ones that sustain the organism’s life) are located near the center of the brain, which gives them the best real estate and the closest possible distances to all the other regions of the brain, and especially the spinal cord.

In left-handed people, different areas of the brain are associated have different functions. For example, while language production is left-lateralized in up to 90% of right-handers, it is more bilateral, or even right-lateralized, in approximately 50% of left-handers. Although left-handedness is associated with many maladaptive traits, it’s sometimes associated with extraordinary cognitive abilities as well. I hypothesize that the SUOP is related to the adaptivity and maladaptivity of left-handedness, when combined with different genes. The idea is that changing the neuroanatomy of the brain would change the brain’s abilities. Different brain structures (including different lateralizations) optimize different cognitive functions. So, it may be possible to relate this observation/hypothesis to the SUOP, as a more general principle.

See: Why It’s Good To Have A Weak Hand - Minute Earth.

These other concepts revolve around competition for spots within a fixed reserve or supply that can support the objects occupying the spots or spaces within that reserve, particularly when all the spots within the reserve are equally (or near-equally) valuable. They are distinguished from the previous examples by not depending on the arrangement of objects within a physical space, but rather by whether the object is merely occupying the space or not. Many of these spaces aren’t 2D or 3D:

- Tasks and errands compete for our limited attention spans in our finite 24-hour day cycles (so there is a limited number of work/tasks we can do each day). The only way to spend more time doing something is to spend less time doing something else that’s less important.

- On a CPU (single core or multi-core), processes all compete to run through the CPU’s finite number of cores. Only one process can occupy a physical core at a time (or multiple, if there are virtual cores), so an efficient operating system must prioritize running the most important processes first, according to a specific set of criteria.

- If you have a hard drive that can only store a limited number of things, then you would probably want to store the most important things on the hard drive in order to get the greatest value out of your hard drive.

- Only the fittest organisms can manage to survive and populate an environment that has a fixed carrying capacity. Whether by natural causes or by population control, every organism can only exist at the cost of another. The same principle applies for reproduction licenses.

- Memes compete for slots/space in our minds since there is a limited amount of memes, ideas, and activist causes that any single person could promote at only one time.

- Portions of the Electromagnetic Spectrum (for radio communication licenses).

- Geostationary Orbits.

- Domain Names.

Georgism is merely an extended application of the Space Optimization Principle to land distribution and all other forms of economic land. For all these other applications, the arrangement of objects in a given 2D/3D space matters greatly. Any change to the arrangements that causes space to be used less efficiently would have huge negative impacts on the functionality of the system. In all of these situations, that is clearly something that we should strive to avoid, so why would it make any sense to not do the same for land distribution? If land value is not taxed, then there is no guarantee that it will be used as efficiently as possible. By contrast, the OATP is finder’s keepers, so there is nothing to ensure that land (space) is being used as efficiently as possible. The OATP naturally leads to suboptimal outcomes to everyone overall.

If there’s such thing as “space utility”, can there be such a thing as “time utility”? Wouldn’t that just be the prioritization of the execution tasks within time? – Probably, yes.

Also see: A Critique of “Utility”.

5. NRT as a More Efficient Way to Bootstrap Market Prices

5.1. What Are Prices?

Main Article: Natural Resource Taxation – Blithering Genius.

Prices are just exchange rates, nothing more. They don’t reflect the inherent value of anything.

Markets are an excellent mechanism for organizing production and distribution, but they don’t generate prices ex nihilo. Market prices are circular. The price of a product depends on three factors:

- The prices of the inputs to its production.

- The prices of competing products.

- The supply and demand for the product, given the prices of other products.

So, prices depend on prices. Markets are a way to continuously optimize a collection of prices relative to one another, but this circularity must be bootstrapped for markets to work. In modern societies, prices are bootstrapped in an ad hoc way, using a combination of resource extraction fees, regulations, licenses, taxes, government fiat, etc. This causes market prices to depend on external conditions in ways that are random and unclear, without any design or plan.

– Blithering Genius, “Natural Resource Taxation”

5.2. What Does It Mean To “Bootstrap” Prices?

Bootstrapping is about getting a circular process going. Natural resource prices partially determine the cost of goods and services in the economy, but not entirely. Market prices are circular, so they need to be bootstrapped in some way. Money is another example of a circular flow that has to be bootstrapped in some way, which is typically done with debt.

The best way to bootstrap market prices is to appraise the physical inputs to the economy (natural resources) based on their utility, scarcity and downstream effects (such as pollution). Natural resource taxation should be applied at the point of use, extraction, or degradation. All prices ultimately depend on the prices of natural resources, and the prices of natural resources are not entirely determined by the market. We have exactly two choices:

- Set a baseline for regulating prices, thus leading to a more stable, more predictable economy.

- Don’t set a baseline that controls all the other prices, thus leading to an unstable, unpredictable economy.

There is no justification for why the second option is better than the first.

5.3. Addressing Objections To Bootstrapping Prices With NRT

Taxing natural resources would only be a form of price-fixing.

This claim misunderstands what prices are and why they exist. Prices are information used for allocating resources efficiently. They make it possible for economies to function without a central planner. Since the costs of natural resources cannot be determined by human preferences alone (as explained below), and since they partially determine all the other prices in the economy, we cannot allocate natural resources efficiently if we don’t appraise natural resources in the first place. If prices in the economy are not bootstrapped, then that would defeat the purpose of prices. By contrast, price-fixing would be an arbitrary price ceiling or price floor that decreases the efficiency of allocating natural resources.

Human preferences can bootstrap all other prices.

No, they cannot. Human preferences certainly influence prices, but “human preferences” are not sufficient for bootstrapping market prices because human preferences also depend on prices, which depend on prices, which depend on prices, and so on, which ultimately depend on the prices of natural resources.

The cost of labor can bootstrap all other prices.

No, it can’t. Realistically, the cost of building almost anything in the real world is never going to be very simple, especially if everything is being produced on an industrial scale. Even for something as simple as a pencil, that still requires a lot of natural resources for its production, as Milton Friedman once beautifully demonstrated. And then we have to consider all the prices and factors that went into producing the tools, erasers, metal bands, yellow paint, etc that were used to build pencils and such. All those prices eventually depend on the prices of the natural resources that were used to build the pencil.

But natural resource taxation would require price-setting by government bureaucrats, which is an opportunity for corruption.

That is true, but prices have to be bootstrapped somehow. Markets aren’t magic. If anything, implicit ad hoc pricing creates even more opportunities for corruption and evasion, in comparison to taxing natural resources at the point of extraction. If the government doesn’t set prices for natural resources, then markets won’t be bootstrapped, and we’ll have a tragedy of the commons. Additionally, anybody who insists that natural resource values can never be fairly appraised would have to reject the validity of all the other general variables on this list, lest they would have contradicting beliefs.

5.4. What Henry George Didn’t Understand About Assessing Land Values

In Chapter III: The Proposition Tried by the Canons of Taxation from the original version of Progress and Poverty, Henry George wrote the following paragraph:

But there is no necessity of resorting to any arbitrary assessment. The tax on land values, which is the least arbitrary of taxes, possesses in the highest degree the element of certainty. It may be assessed and collected with a definiteness that partakes of the immovable and unconcealable character of the land itself. Taxes levied on land may be collected to the last cent, and though the assessment of land is now often unequal, yet the assessment of personal property is far more unequal, and these inequalities in the assessment of land largely arise from the taxation of improvements with land, and from the demoralization that, springing from the causes to which I have referred, affects the whole scheme of taxation. Were all taxes placed upon land values, irrespective of improvements, the scheme of taxation would be so simple and clear, and public attention would be so directed to it, that the valuation of taxation could and would be made with the same certainty that a real estate agent can determine the price a seller can get for a lot. – Henry George

This paragraph seems to be the only part of Progress and Poverty where George talks about how land values should be determined. It’s clear that George wanted the government to assess the value of land, but it’s not clear how he thought the government should approach it, or if he ever thought about that at all. In particular, the last sentence in the paragraph suggests that George was not aware of the circularity of market prices or how the prices for natural resources influence all the other prices in an economy. If he was aware of this, then he would’ve understood that a rational government would approach the value assessment of land and natural resources much differently from how a real estate agent would under our current economic system.

Henry George took it for granted that the government can “assess” the value of land in monetary terms, but that is impractical. It’s not possible either unless the government implements ad hoc regulations for setting prices, which would be economically inefficient. By contrast, our proposal for natural resource taxation would be much more efficient.

6. Clarifying Collective Ownership And Natural Resource Taxation

6.1. Today’s Unequal Ownership Of Resources

Prices for natural resources should be defined in a principled way,[5] based on their utility, scarcity, and negative externalities (e.g. pollution). Natural resource taxation should be applied at the point of use, extraction, or degradation. Land should be taxed based on the potential uses of the land, the land’s location value, and the state-provided infrastructure in the region. Biological resources, such as lumber and fish, should be taxed based on sustainability and balancing other uses. (Forests are not just a source of lumber. They also provide wildlife habitat, watershed management, recreation, etc.) Geological resources, such as iron and coal, should be taxed based on their scarcity, long-term value and downstream effects. The use of water (other than rain) should be taxed. Land taxation would take the value of rainfall into account. Air and water pollution should be taxed.

– Blithering Genius, “Natural Resource Taxation”

Today, we can observe that there are enormous corporations like British Petrol or De Beers that became super rich due to their monopolies and private ownership over things like oil, natural gas, precious metals, diamonds, etc. Many of these corporations earn billions of dollars every year. But is it really fair that they should get billions of dollars annually, just because they managed to claim the land containing those natural resources before anybody else could, under a Finders’ Keepers system? They certainly deserve some money for doing the labor necessary for extracting those natural resources, but they didn’t do any labor to physically create the resources. That is called rent-seeking, and it doesn’t contribute to economic growth at all. If anybody is going to be making billions of dollars off of selling coal, oil, iron, copper, cobalt, natural gas, etc, it better be the government so that everybody else can pay fewer taxes. Most economists agree that land monopolies and natural monopolies are the greatest monopolies of them all since they have the fewest competing alternatives for when monopolies do form.

Geoists propose that the Earth’s natural resources belong to literally everybody.[2] The government manages this collective ownership in order to resolve the tragedy of the commons (hence, we also support creating a global government). Everybody owning natural resources is the same thing as nobody owning natural resources. So, the idea is that if you want to claim natural resources exclusively for yourself, then you need to stake your claim to them by buying them from everybody (the government). Buying the natural resources from everybody (the natural resource tax) is how you establish your private ownership to do whatever you want with them. The alternative to collective ownership of natural resources is private ownership of natural resources, which leads to economic inefficiency.

But collective ownership of natural resources would entitle lazy people to natural resources.

This misses the point. If everyone (xor no one) owns natural resources, a couch potato doesn’t own the Earth’s natural resources anymore than anyone else does, and vice versa. If a person wants natural resources, then they would have to work for them. And a hard worker will obviously obtain more natural resources than a lazy couch potato. That’s the whole point.

Read More: The Georgist Theory of Property (GTP).

6.2. Norway’s Sovereign Wealth Fund

Norway’s Sovereign Wealth Fund is an ideal example of what collective ownership of natural resources should be like.

6.3. The Differences Between NRT and LVT

The term “Land Value Tax” (LVT) is used more commonly than “Natural Resource Tax” (NRT), but “land” is an ambiguous concept with many different meanings and definitions. “Land Value Tax” typically refers to either: 1. the economic definition of land, or 2. Location Value Tax. Sometimes, people will even use NRT and Land Value Taxation as interchangeable terms because “land” itself is defined as natural resources that exist in finite supply, in the economic sense of the term.

We should note that Henry George was explicitly in favor of taxing natural resources:

The term land necessarily includes, not merely the surface of the earth as distinguished from the water and the air, but the whole material universe outside of man himself, for it is only by having access to land, from which his very body is drawn, that man can come in contact with or use nature. The term land embraces, in short, all natural materials, forces, and opportunities, and, therefore, nothing that is freely supplied by nature can be properly classed as capital. – Henry George

Since it often isn’t clear which definitions people are using, I prefer to use the following definitions:

- “Natural Resource Tax” (NRT) refers to every natural resource, which includes physical land.

- “Land Value Tax” refers to the appraised value of a 2D (or 3D) area of physical land. Location values are included in land values.

- “Location Value Tax” refers to taxes on real estate values.

- “Polution Tax” refers to taxes on any kind of pollution. Carbon taxes are a type of pollution tax.

- “Pigouvian Tax” refers to taxes on any market activity that generates negative externalities (i.e., external costs incurred by third parties that are not included in the market price). Since there are negative externalities to using natural resources, occupying land, and pollution, all Georgist taxes can be considered Pigouvian and vice versa.

Location value taxation is a more specific type of land value taxation that only refers to real estate values, which are mainly determined by a location’s proximity to various goods and services in most cases. Location Value Taxation (LVT) is particularly unique since real estate is the one natural resource that every country has in common, and also tends to be the natural resource with the highest economic value. For that reason, location value taxation would be the primary form of natural resource taxation that makes up the majority of government revenue, under Georgism.

In the appropriate contexts, “Location Value” is often a more preferable term to “Land Value” because it avoids the misconception that Georgists are concerned with land area, rather than location values.

Note that “land value” technically isn’t equivalent to a “property tax on the unimproved value of land”, as some people have claimed. The value of a location has the potential to fluctuate since most of the land value of residential areas is derived from their locations, namely all the businesses, shops, services, etc in the community surrounding that land. In other words, improving the land around the location of a given parcel of land amounts to improving the location (and land) value. This means that, location value tax (and land value tax more generally) will tax parcels based on improvements to the surrounding land, but not improvements to the land parcel itself. People have a right to own all improvements that they make to land that they possess, when those improvements were made using the fruits of their labor.

In Ireland, the term “Site Value Tax” is used instead of “Land Value Tax”. There may be other names for these concepts as well in other regions of the world.

Read More: General Single Measurements For Multiple Variables.

6.4. Exhaustive List of the Commons

Main Article: Exhaustive List of the Commons.

Besides real estate, other sources of Georgist tax revenue include:

- Extractable resources (mineral deposits and hydrocarbons)

- Severables (forests, fish stocks, etc)

- Restrictions/Taxes on pollution or severance

- Currency Taxes (for hoarding money).

- Anything that has economic demand that exceeds a fixed supply:

- Geosynchronous Orbits

- Airway Corridors

- Portions of the electromagnetic spectrum

- Domain Names

- Right-of-way (transportation) used by railroads, utilities, and internet service providers

- Reproduction Licenses

- Et Cetera

All of these would be subject to the appropriate amount of tax, as set by the market for Land Rent.

7. Famous Economists Who Have Endorsed LVT

7.1. Adam Smith’s Endorsement of LVT

Adam Smith, in his 1776 book The Wealth of Nations, rigorously analyzed the effects of a land value tax, pointing out how it would not hurt economic activity, and how it would not raise contract rents.

Ground-rents are a still more proper subject of taxation than the rent of houses. A tax upon ground-rents would not raise the rents of houses. It would fall altogether upon the owner of the ground-rent, who acts always as a monopolist, and exacts the greatest rent which can be got for the use of his ground. More or less can be got for it according as the competitors happen to be richer or poorer, or can afford to gratify their fancy for a particular spot of ground at a greater or smaller expense. In every country the greatest number of rich competitors is in the capital, and it is there accordingly that the highest ground-rents are always to be found. As the wealth of those competitors would in no respect be increased by a tax upon ground-rents, they would not probably be disposed to pay more for the use of the ground. Whether the tax was to be advanced by the inhabitant, or by the owner of the ground, would be of little importance. The more the inhabitant was obliged to pay for the tax, the less he would incline to pay for the ground; so that the final payment of the tax would fall altogether upon the owner of the ground-rent. – Adam Smith, The Wealth of Nations, Book V, Chapter 2, Article I: Taxes upon the Rent of Houses

7.2. Henry George’s Endorsement of LVT

“Now, what is necessary to enable labor to produce these things, is land. When we speak of labor creating wealth, we speak metaphorically. Man creates nothing. The whole human race, were they to labor forever, could not create the tiniest mote that floats in a sunbeam–could not make this rolling sphere one atom heavier or one atom lighter. In producing wealth, labor, with the aid of natural forces, but works up, into the forms desired, pre-existing matter, and, to produce wealth, must, therefore, have access to this matter and to these forces–that is to say, to land. The land is the source of all wealth. It is the mine from which must be drawn the ore that labor fashions. It is the substance to which labor gives the form. And, hence, when labor cannot satisfy its wants, may we not with certainty infer that it can be from no other cause than that labor is denied access to land?” – Henry George, Progress and Poverty, Book V, Chapter I, Page 272.

“But if one man owned the island, and if we went there and you people were fools enough to allow me to lay claim to the ownership of the island and say it belonged to me, then I could charge a monopoly rent; I could make you pay me every penny that you earned, save just enough for you to live; and the reason I could not make you pay more is simply this, that if you would pay more you would die. … ”If we were to go to that island that we imagined, and if you were fools enough to admit that the land belonged to me, I would be your master, and you would be my slaves just as thoroughly, just as completely, as if I owned your bodies, for all I would have to do to send you out of existence would be to say to you “get off my property.” That is the cause of the industrial slavery that exists all over the world, that is the cause of the low wages, that is the cause of the unemployed labor.“ – Henry George, The Land for the People, Speech 1889.

7.3. Milton Friedman’s Endorsement of LVT

Watch: Milton Friedman’s Endorsement of Land Value Tax.

In my opinion, the least bad tax is the property tax on the unimproved value of land, the Henry George argument of many, many years ago.

– Milton Friedman, Source

In spite of their radically different economic philosophies, one of the few things that Milton Friedman and Vladimir Lenin could both agree on was that Georgism is a massive improvement to Capitalism:

It amounts to the transfer of rent to the state, i.e., land nationalisation, by some sort of single tax along Henry George lines… The difference between the value of land in some remote peasant area and in Shanghai is the difference in the rate of rent. The value of land is capitalised rent. To make the “enhanced value” of land the “property of the people” means transferring the rent, i.e., land ownership, to the state, or, in other words, nationalising the land. Is such a reform possible within the framework of capitalism? It is not only possible but it represents the purest, most consistent, and ideally perfect capitalism.

– Vladimir Lenin, Source

8. Our Disagreements With Henry George

We disagree with Henry George on the following points. We have many other disagreements, but these are the main ones:

- Henry George took prices and value for granted when he was talking about how land value tax would be assessed. He didn’t understand that it would be more efficient if the government appraises the value of natural resources, which would bootstrap all the prices in the economy. It’s not practical (or possible) for a government to assess natural resource values the same way real-estate agents do.

- Henry George was harshly critical of Malthusianism and Neo-Malthusianism. The former is warranted to some extent, but the latter is not. We’ve refuted Henry George’s defense of Cornucopianism.

- Henry George supported a Citizen’s Dividend, which is known today as Universal Basic Income (UBI). We agree with Georgists that taxes on natural resources would make UBI feasible, but we do not support UBI.

- We don’t propose that Natural Resource Taxes should be the only taxes in society. We support having a small, flat head tax applied to all citizens.

- We support demurrage currency, whereas George doesn’t have any explicit views on what currency a society should use.

- Henry George was a proponent of a variation of the Fructification Theory of Interest, which also combined “reproductive or vital force of nature” (basically capital that can grow and reproduce) as a secondary source of interest, besides land. We instead support Silvio Gesell’s and John Maynard Keynes’ Liquidity Preference Theory of Interest.

- Henry George believed in morality. We believe that morality is an illusion. Moral disagreements are always inevitable, because morality is not real.

- Henry George didn’t believe that landowners are entitled to compensation, as he compared private landownership to slavery. I agree that many or most of society would like to see some or many landowners receive no compensation, but it’s difficult to exclude people from compensation, due to differing opinions and the balance of power. This would’ve been a more viable and more practical idea during George’s lifetime. But it’s ultimately not a good idea in today’s world, since so many people (including much of the middle class) has invested their personal finances into buying houses and land. From a practical perspective, it will make it be much harder to nationalize land ownership if landowners aren’t compensated, so much so that it will probably become socially impossible.

- Henry George favored the Environmental Hypothesis, whereas we favor the Hereditarian Hypothesis.

- Henry George had a naive theory of civilizational decline, whereas our theory recognizes the importance of fossil fuels, population dynamics, applied evolutionary biology. We also understand that the scale of technology depends on the scale of civilization. Our theory is more realistic.

I tend to refer to my proposal to use Pigouvian taxes and tax natural resources as “Georgism”, since it’s already a widely used term that’s associated with similar proposals. However, it must be clear that the economic policies that I propose are not the same as what Henry George proposed. There were a collection of economists throughout history who also proposed taxing land and natural resources, so Henry George wasn’t the only one.

Blithering Genius and I are just another two of the more modern economic thinkers in favor of NRT, and dare I say, the most innovative ones. The ideas that we propose on how natural resource taxation should be approached, how it should be done, what to do with the tax revenue, the implications of Georgist theory, etc are quite from most previous pro-LVT economists. Our proposals should not be thought of as a “corruption” of George’s thinking, especially when most of George’s ideas weren’t very original to begin with. His thinking and proposal were built on the thinking of others who lived before him, like David Ricardo.

Read More: ZC’s Book Review for Progress and Poverty.

9. Any Potential Drawbacks?

Any conversion over to a Georgist taxation system would have to be a gradual process, taking at least 30 years in order to give everybody enough time to re-adjust their personal finances, especially for the people who are relying on land speculation as part of their retirement portfolio. But once society is through that, the economy will be better off than it was before the transition and it should be smooth cruising from there on out. Freiland might make it easier to switch to a Georgist-like system faster.

The most important question regarding the implementation of Georgism is how the value of natural resources would be assessed everywhere. This page talks about how that could be done for land value, while prices for other natural resources would be set according to their utility, scarcity, and downstream effects (including pollution). There is the some concern that land values could be appraised in such a way that promotes corruption or cronyism, but this isn’t a very good argument because prices have to be bootstrapped somehow. If anything, implicit ad hoc pricing creates even more opportunities for corruption and evasion, in comparison to taxing natural resources at the point of extraction. If the government doesn’t set prices for natural resources, then markets won’t be bootstrapped, and we’ll have a tragedy of the commons. Additionally, anybody who insists that natural resource values can never be fairly appraised would have to reject the validity of all the other general variables on this list, lest they would have contradicting beliefs.

In order for land value and natural resource taxes to be truly effective, they must be widespread (and preferably regulated by a global government), otherwise those who don’t have to pay a natural resource tax will have an advantage over those who do. Likewise, if a Georgist government imposes taxes on negative externalities, like pollution, there would need to be a tariff on goods from countries which didn’t impose such a tax. Otherwise you would just be subsidizing pollution elsewhere.

Some people are skeptical that Georgism would be sufficient to fund governments. However, this is unlikely to be a problem since (almost) all taxes come out of rent (ATCOR). The Henry George theorem also suggests that switching to Georgism would actually increase government revenue in the long run, since land rents would increase due to land being used more efficiently.

Footnote 3 describes another possible drawback.

If everybody owns land equally and the population increases, then this creates two problems:

- The Iron Law of Wages would eventually apply to society since evolution always selects for high-fertility.

- The absence of population control would make it theoretically possible for different factions of the population to increase their fertility, in order to collectively receive a greater proportion of the citizen’s dividend (if there is one).

Both of these issues could be resolved by population control, which will inevitably be necessary anyway sooner or later in order for modern civilization to avoid collapsing and continue prospering. Most Georgists would like to believe that populations are self-regulating, but there’s no evidence to prove this. The Overpopulation FAQs on this site and my rebuttal to chapters 6-9 of Henry George’s Progress and Poverty both explain why Cornucopianism is wrong.

Also see: Why is reducing immigration in Western countries a higher priority than Georgism?

We don’t propose that natural resource taxes be the only taxes for a society. They should make up the majority of government revenue, but each of the following taxes have important functions in society:

- Head taxes would help partially resolve the free-rider problem with respect to government services, would distribute influence over the government, and don’t discourage the production of wealth. Since head taxes are the opposite of Universal Basic Income, it’s not possible for a society to have both, so we propose other alternatives instead.

- Reproduction taxes aren’t proposed by most Georgists, but they are within the scope of taxing collective rents. So, they’re basically just Georgism applied to population control and carrying capacities.

- Tariffs could have geopolitical advantages when used strategically.

- To some extent, inflation is a consequence of fiat currency and economic growth.

See: Economic Literature Review Summarizing Studies On Land Value Tax.

Lastly, see the Georgism FAQs page, the Henry George AI Robot, or the Georgism Subreddit for any other questions you may have.

Footnotes:

Georgism is sometimes called Geoism. Historically, it was known as the Single Tax Movement.

Georgism achieves equal or near-equal ownership of natural resources for everybody by redistributing natural resource values from the possessors to everybody else, whether they possess any natural resources or not (after all government revenue is paid). It’s debatable whether this is truly “equal ownership of land” since paying the government revenues is prioritized over redistributing the value of all natural resources, but it’s still true that it’s a more equitable redistribution of the Earth’s value nonetheless. Alternatively, Freiland could nullify this debate altogether, since it works differently to Georgism.

Although there is a consensus among economists that Land Value Tax cannot be passed onto the tenants, most of these conclusions have not taken into account the effects of capital markets at all. It could be the case that higher tax rates might cause an exodus of capital from real estate, unless there are factors that this arguments fails to account for. If this effectively makes it possible to pass LVT onto the tenants, then LVT would not be a progressive tax that primarily taxes the wealthy (but that is not to say that wealth equality is a particular important goal for society). We may not be able to know the exact effects that LVT has on tenants until we try it, but if there are any problems, we may be able to resolve them with government regulation(s). Additionally, if LVT can demonstrably be passed onto the tenants, then we could try Silvio Gesell’s Freiland as an alternative to Georgism.

Having an equal right to be productive means having an equal opportunity to be as productive as anyone else.

We are aware of the economic calculation problem, and we recognize that any appraisal of natural resources based on utility, scarcity, and externalities is ultimately subjective. But this would still be more preferable than using ad hoc pricing instead. No economist has given a justification why the latter should be better than the former. It’s also logically inconsistent to oppose land value appraisal, if one supports other g-factors.