Thoughts On Economics

Miscellaneous Musings

Note: This file is just a place for me to gather miscellaneous thoughts and musings that I have on economics that don’t fit in other files. I might add more sections to this file when I feel that I have more solid ideas that are worth publishing.

1. Scarce Resources

1.1. The Laws Of Physics

The physical limits of reality ultimately determine what is economically possible or optimal.

The Space Utility Optimization Principle is a great example of this.

1.2. Creating A System With Stable Growth, De-Growth, And Wealth Generation

1.3. The Flaws Of GDP

Contrary to popular belief, GDP isn’t a useful metric or a particularly meaningful number.

- There are lots of non-financial transactions that don’t get recorded in developed countries. Families or villages working together is more common in such countries. Completely self-sufficient societies have a GDP of zero, while they’re just as happy as people in developed countries.

- When things cost less, transactions also count for less. If a burger costs $2 and not $10, that’s 1/5 of the transaction, while the same goal is reached. GDP doesn’t account for price differences between countries.

- GDP doesn’t account for national debt. A lot of countries that have high GDP growth may seem like they have a lot of economic growth, but a lot of this GDP growth is only possible because the national debt is allowed to increase. The GDP growth can be superficially high, when government expenditures are high and taxes aren’t high enough to pay for them.

- Transactions on the black market are not recorded.

- There are lots of tricks which are used to deliberately inflate the real GDP of some countries, like imputations, hedonic adjustments, and inflation.

- Planned obsolescence and labor inefficiency are a big deal. It raises the GDP of developed economies, while doing nothing to improve quality of life.

- The production of cars and car-centric infrastructure is also included in GDP, even though the car is probably one of the worst inventions ever created in human history. Cars have made developed countries poorer, not wealthier.

- Ireland and countries that are strongly reliant on natural resources (like oil) might be some of the most extreme examples of how GDP doesn’t accurately reflect the size of their economies or production.

- Market capitalization is a semantically invalid concept.

- Economic “Utility” is a questionable concept.

There’s probably other things that I haven’t mentioned as well. Instead, I prefer the term “prosperity”. Having high wealth and prosperity is more important than having a high GDP.

1.4. Better Alternatives To GDP

Furthermore, the following metrics and information are better indicators of an economy’s status or health:

- The government debt

- The government deficit

- The interest rate

- The inflation rate

- The national income distribution? - Price Dependent

- The cost of living distribution? - Somewhat Arbitrary

- The distribution of each citizen’s savings? - Somewhat Arbitrary

- The rentier and homeownership rates? - Somewhat Arbitrary

- The social mobility rate? - Somewhat Arbitrary

- The employment, unemployment, underemployment rates? - Somewhat Arbitrary

- The main occupations of the workers? - Somewhat Vague

Read More: A Critique of “Utility”.

1.5. Geo-Economics Musings

The geographic features of the United States, such as the Great Plains made it easy for the US to have lots of farms and slaughterhouses dedicated to raising lots of beef. Other countries don’t have these geographic features, such as Japan, which had very little farmland for raising livestock. Additionally, the Japanese lived on an archipelago of islands, so most Japanese people historically got most of their meat from fish and other seafood. So, we can see some clear examples of how the different geography of countries affected the diets of the people, which also affected the nutrition, health, and intelligence of those populations.

Unfortunately, since the US has lots of companies that are dedicated to raising beef, those companies eventually hacked into the government’s corporatocracy. They now receive many government subsidies, legal exemptions, and unfair business regulations that make it easy for them to sell more unhealthy food to the people.

Additionally, Japan is also much more reliant on high-speed rail for transportation, largely because the geography of the country and the high urban density makes it very practical as a means of transportation. By contrast, the sprawling land of the United States strongly incentivized urban sprawl, and also incentivized cars for transportation, which gave rise of the overpowered automobile industry, lots of overpowered car dealerships, and inefficient infrastructure. So even though the United States has the economic advantage of having lots of real estate and natural resources, Japan’s lack of real estate seems to have ultimately lead to a more efficient, economic, infrastructure, and fewer powerful companies that have conflicts of interest with the people.

As far as I know, Japan does not have any such similar situation where the interests of companies conflict with the interest of the people in a similar way.

Also See: Why Poor Places Are More Diverse - Minute Earth.

Georgism and improved urban design could make it possible for more people to air dry their clothes instead of using dryer machines, without sacrificing privacy or other benefits. This would help lower energy consumption and increase the sustainability of clothes, both of which would make modern civilization easier to function. More space would be required to air dry clothes, but this would be at least partially compensated by eliminating space that would otherwise be occupied by drying machines.

2. Value, Prices, and Marginalism

2.1. Currency

WTF Happened In 1971?: This site has a lot of graphs and metrics that changed radically after 1971, the same year that the US ended the gold standard.

See: Wikipedia: Demurrage Currency.

See: Demurrage Currency FAQs (Work In Progress).

In every trade, there is an exchange between one party to another party. Both parties are buying and selling the offer made by the other party, and they mutually agree to do that. However, in many cases when the exchange for the trade happens, party A must give their offering before party B can give their offering in return. In this trade scenario, there is a prisoner’s dilemma. In particular, there is the potential possibility that party B receives the offering of party A before party B gives their offering to party A, and that party B proceeds to runaway or sabotage the trade by not giving their offering to party A. My intuition is that because there is the possibility for defection in many trades, the second party who gives their offering after the first party is the one that has more power over the determining trade. If one party has more power than the other, then they would choose to do the trade exchange in a way that reflects their greater power over the other party. This is particularly true for barters, informal trades, and exchanges involving cash.

In most cases, trades that involve exchanges services for money (and vice versa) tend to have the money paid after the service was completed. At most companies for example, workers usually don’t receive their paychecks until days or weeks after they had done their work hours. It’s also not unusual for patients to pay their medical providers after a visit or treatment(s) were done. And it’s also common for people to pay a handyman to work on their house or property after they did their due labor.

2.2. Cash Versus Gift Cards

Cash is vastly more flexible than a gift card. It can be used anywhere, it never expires, it can be converted to digital currency if needed, it can be placed into a savings account (if the recipient chooses), and it’s not possible to run into unfortunate scenarios where there’s money left on the card, but it’s not worth buying something else to just spend it. And unlike gift cards, you don’t have to worry about fraud cases where the money on the card was redeemed before you could actually use it, which has happened to some unfortunate people.

In most cases, gift cards don’t have any practical advantages over cash, so it simply doesn’t make sense to give people gift cards when you could give them cash instead. It’s unreasonable to view cash gifts as “tacky” when it’s worse to give gift cards. It’s okay if you don’t know what to get someone. Instead of viewing cash as inferior to gift cards for “lacking thoughtfulness”, a rational society should instead view cash as a gift or favor of one’s energy/work to the recipient (See: Family and Society). Normalizing giving cash to people as gifts would also help improve economic efficiency, since it would eliminate scenarios where the recipients don’t end up using the gift cards, for whatever reason(s).

Gift cards are often non-refundable after being purchased for multiple reasons. A gift card could have been partially used, and partial refunds for products are unacceptable at most retailers. A big box store retailer that sells gift cards usually has no way to check gift card balances for cards at brands other than their own, which makes it difficult to verify that the gift card was never used. Additionally, if a gift card is activated at the point of sale (POS), then refunding it would require deactivating it and then reactivating it, which is either complicated or impossible. The inability to refund gift cards is inconvenient.

Gift cards also sometimes have activation problems, which furthers their inconvenience.

Gift cards (and prepaid debit cards) make it easier for some people to commit scams or fraud, since their financial transactions are more difficult to trace. If a person is trying to scam someone, then gift cards are a good idea from their perspective. However, it’s socially negative to make it easier for scammers to win, which provides justification for society to discourage people from using gift cards.

The only good reason to use gift cards instead of cash is if the gift cards can be bought as a discounted price compared to how much money-value they have, and if the buyer knows that the intended recipient would use it. If the recipient of a gift card is good at personal responsibility, then many of the other supposed benefits of gift cards are disadvantages, not benefits. Some of the supposed advantages are also things that could be achieved with cash too (e.g. adding a personalized message or packaging within a greeting card that has the cash inside it, or giving a suggestion on what to spend the cash on, etc).

Some may argue that the point of giving gifts around Christmas time is to show thoughtfulness towards the recipient’s desires and interests. Our culture has been programmed to think that giving cash does not accomplish that. One possible reason is that if two people gave each other the same amount of cash as gifts for each other during Christmas time, then the cash exchanges aren’t really “gifts” because they cancel each other out. While this is understandable, giving gifts for the sake of giving gifts is not good because consumerist culture, endless economic growth, and humanity’s consumption of resources cannot last forever. Perhaps an ideal culture would present giving cash as a new meme for helping humanity end its dangerously increasing economic and consumption growth.

In my opinion, the biggest strength of gift cards is when they given as store credit for product return refunds at retailers, when they are a possible refund option. Instead of having to wait anywhere from 1 to 5 or even 10 days for a product return refund to return to one’s debit or credit card, gift cards can usually be activated and granted immediate funds, once the refund is processed. I wish that product return refunds were instant, just as purchases often are. But since this isn’t always possible, this thus makes gift cards a popular option for refunds, especially for broke people who live paycheck to paycheck and need whatever money that can get instantly for buying things.

Some gift cards can also be used to buy things online, which is a strength that cash cannot achieve. But there are few reasons why electronic money can’t be sent as a gift.

2.3. Quantity Negotiation

Most people know the importance of negotiating one’s starting salary at a job interview. If you argue for a salary that’s too low, then you’re undercutting yourself, especially if the employer has to meet you halfway. Likewise, arguing for a salary that is too unrealistically high may also leave a bad impression on the employer or cause you to forfeit the job offer. Alternatively, we could also view this from the employer’s perspective of wanting to pay prospective employees as little as possible. Regardless, it’s not easy for either party to get the exact salary that they want. From the employee’s perspective, some good strategies may be to give a salary range where the lower end is close to the average salary for the position, with the rest of the range leaving some buffer room for a higher salary negotiation.

A comparable scenario is arguing for tax cuts or drastic reductions to mass immigration. If you want to reduce immigration, and you know that a political compromise must happen between the pro-immigration and anti-immigration parties, then arguing to reduce immigration by what most people would view as acceptable could backfire if the pro-immigration parties make you meet them halfway. If you know that immigration can only be reduced by a fraction of what we really want once the compromise happens, then it might more sense to make more extreme demands, so that the other party will try to meet you halfway. The same goes for arguing for tax cuts.

In such a scenario, it’s also probably inevitable that there’s going to be both: 1. a faction that wants to moderately reduce immigration, and 2. a faction that wants to drastically reduce immigration anyway. In this case, I would argue that it’s a good thing to have both factions, not just one. One could campaign for the more extreme immigration reduction camp, and fall back on the more moderate camp if the demands are too extreme to be accepted by the rest of the public. On the other hand, if: 1. we make more extreme calls to reduce immigration and the extreme camp has a substantial amount of support, and 2. the leftists have to compromise with us, then the compromise will have to be closer to the anti-immigrant side, since the compromise would have to meet both sides halfway, by definition.

Similarly, Israel has removed its remaining tariffs on US goods ahead of Trump’s tariff implementations. This way, when Trump places tariffs against Israel, Israel can apply reciprocal tariffs against the United States that actually keep the country’s tariffs where they were before.

2.4. Wage Dependency Thought Experiment

In a basic thought experiment, one might think that paying people less would cost them to work less. If you think about it, someone who is paid only one dollar an hour is not going to be incentivized to work as much as paying him say, seven dollars an hour. And as with everything else, we know that taxing some things will encourage things to be used less. Just like how income tax causes people to want to work less, how sales tax makes people want to buy things less, how land value tax makes people want to own less land, etc. So one should think that from this experiment, it should be implied that paying people more and giving workers raises after they have worked for a certain amount of time and got a lot of experience, that they would be motivated to work more. But this isn’t completely true.

In another thought experiment, we can recognize that if some people got paid say, $1000 an hour, then eventually they could work enough hours to the point where they would not even need the job anymore. Some people only want to gain financial independence early in life, so they can retire early enjoy the rest of their life. This suggests that paying people more will not always incentivize people to work more. Sometimes paying people more can incentivize people to work less.

These two thought experiments suggest that there may be a soft spot or a soft range for paying people that will cause them to work the greatest number of hours. We can also connect this thinking to some form of planned obsolescence, where the worker is dependent on the employer for a wage, and hence work for that employer to get said wage. The worker is dependent on the employer. This dependency relationship gives the employer leverage over the employee, assuming that there are enough employees for the employee to choose from, such that they don’t have to worry about the employee trying to assert themselves further needs and wants.

Also see: How To Go To War With Your Employer - Drew DeVault.

Related: You Are Witnessing the Death of American Capitalism – Benn Jordan.

3. The Efficiency of Markets

3.2. Preventing Monopolies

Wikipedia: Cornering the Market

Sometimes you get something because you want to use it. Sometimes you get something because you want to stop someone else from using it. Even if you yourself have no use for it.

Article: Musk Proposed Hyperloop to Stop California High-Speed Rail. Elon Musk stopped a major high-speed rail project, just so he could make money selling electric cars, even though completing the HSR project would’ve been better for consumers, the environment, resource consumption, etc.

4. The Efficiency of Government

4.1. Infrastructure

If there is a situation where massive scale is needed to make infrastructure profitable to build, but massive infrastructure is simultaneously needed to significantly increase the scale of something sold (e.g. the electrical vehicle charging problem where there simply isn’t enough infrastructure around yet for EVs), then government intervention is necessary to fix this market failure. Of course, having high speed rail would be even better than having electrical vehicles and related infrastructure.

If the government sets the price of natural resources, and the government does not have to pay to buy the natural resources necessary for building infrastructure, then that could potentially create a game theoretical problem where people lobby the government to build infrastructure that benefits them, so that they don’t have to pay the out-of-pocket costs that the natural resources would’ve costed if they had built it privately themselves.

4.2. Who Pays Taxes And Who Has Influence Over The Government

If all taxes are replaced by taxes on natural resources, would a head tax still be reasonable for distributing government influence?

We do support head taxes since they help solve game-theoretical problems.

- Scenario 1: No head tax for equally distributing influence over the government is needed to distribute influence over the government. This could happen if it is the case that: although land-renters are the only revenue generating demographic, their greater influence over the government comes at the cost of having to pay higher taxes to the government. In the current non-Georgist world, rich people will do whatever they can to avoid paying taxes while retaining their strong influence over the government. In a Georgist world however, rich people may not be so keen to have that strong influence if it means that they must pay the highest taxes for all of the high-value land that they are renting. If that turns out to be the case, then everything works out fine, and there are no problems that could arise from this concern.

- In a way, everybody would be paying taxes in an economy that exclusively taxes natural resources to an extent, since all the prices in the economy would depend on the appraisal of natural resources.

- Scenario 2: If it can be proven that land renters are able to pass at least some portion of the LVT onto tenants, then the tenants would be indirectly paying LVT anyway, and thus they would already be paying for the government’s services to an extent via that indirect manner. But if this is the case, then it would have to be calculated and verified regarding exactly what percentage of LVT is able to get passed onto tenants for all the various ways that land can be used (housing, farming, etc).

- The head tax would guarantee that not all of government revenue is exclusively made from people renting land and purchases on government-owned/managed natural resources. It can be argued that this would be a good thing because non-land renters are still using at least some government services, so it could also be unfair for them to receive them without paying anything at all. Additionally, one of two scenarios could occur if one voting demographic has more power than the other (land-renters versus non-land-renters):

- Scenario 3: The land renters have the most power since they pay nearly all the government revenue.

- A head tax would limit land renters’ ability to have a monopoly of influence over the government (since they would be the only revenue generators, aside from people revenues generated by the government selling natural resources). The head tax would distribute influence more equally over the populace, thus limiting the power of the land renters to how ever much the head tax rate is.

- Scenario 4: The people have the most influence over the government because they are the majority and the bulk of the democratic populace and voting block:

- People who are not land renters would be less incentivized to demand maximum government services since they wouldn’t be free to those people and would affect non-land-renters to at least some extent via the head tax rate.

5. The Efficiency of Labor

5.1. Ghost Jobs

Ghost job postings by companies could enable employers to make their employees believe that they are replaceable, which may incentivize them to work harder. It could also give the illusion that the company is growing, when it actually isn’t.

- This should arguably be illegal since the company would be lying, and it’s no different from a store that advertises a product and doesn’t have it, or from someone who places a bid in an auction but doesn’t have the money to buy the item that is being bid.

- This could also waste job seekers and unemployed people’s time, which hurts economic development.

- How could this tactic help increase labor efficiency, without wasting job seekers’ time (if possible)?

5.4. Leveraging Non-Profits More Effectively

Cases Where Non-Profits Outperformed For-Profit Entities

- FOSS Software: The GNU Project, which created gcc (GNU Compiler collection), Linux, git, VLC, audacity, GIMP, Bitwarden, Firefox, e

- Non-Profit colleges outperform for-profit colleges by every measures: affordability, quality, etc.

- The pioneering of the GEDCOM file formats and software by the Mormon Church.

- i

- i

6. Patent Reform And Innovation/Proof Bounties

Video: The Case Against Patents - PolyMatter.

Video: How to Fix the Broken Patent System - PolyMatter.

A portion of the government revenue would be set aside to provide monetary awards and official recognition to anybody who manages to create a major innovation and document it. The division of government that is responsible for describing problems to be solved for monetary rewards and distributing the rewards to the winners would also provide rewards for people who solve major mathematical and/or scientific problems.

There are already some unsolved mathematical problems and propositions where people will be rewarded prize money if they can successful prove them to be true, false, or unfalsifiable (e.g. The Millennium Prize Problems). These problems are a good example of a bounty system that is already in place, but only for mathematical problems. This monetary rewards can and should more unsolved mathematical and scientific problems. Providing rewards will incentivize more people to attempt solving them. Whenever possible, it’d be more optimal if these bounties are provided by companies and charities, rather than the government (to save tax revenue).

Related: Which Countries are Granted the Most New Patents?

Related: Wikipedia: Bounty (reward).

7. Philosophy Of Planned Obsolescence

7.1. The Problem Of Planned Obsolescence

Video: The Problem of Planned Obsolescence – Veritasium.

Wikipedia: The Phoebus Cartel.

Planned Obsolescence is a result of a mismatch between a provider’s and a receiver’s values. It is most often between a corporation’s values and consumer values, although it can take place in other forms too. The only obsolescence that should be supported is technological obsolescence (e.g. replacing CRT monitors with LCD monitors).

With design and styling, there is no “best”, there is only “different”. When it comes to planned obsolescence, there is no “best”, there are only differences in fashion and design.

7.2. Forms of Planned Obsolescence

To a great extent, I’d argue that planned obsolescence is one of the most powerful, asymmetrical relationships that a supplier or service provider can have against their recipients because it causes the recipients to be dependent on them. Planned obsolescence deprives consumers of autonomy and independence.

- The most widely recognized form (Classic Planned Obsolescence) is when corporations intentionally produce inferior products that need to be replaced in the future. Examples:

- Video: The Real Reason McDonalds Ice Cream Machines Are Always Broken.

- In March 2019, Google deliberately made Google Search less efficient to increase the number of queries (and ad revenue) sent to its search engine.

- Lumberjack, deforestation, and logging companies may plant trees, so that their companies will be paid to chop them down decades later.

- Inefficient suburban development, landscaping, and construction may make people less self-sufficient, and thus more reliant on buying things that they wouldn’t otherwise need.

- If therapy and dating apps were good at solving people’s problems, then they’d go out of business.

- Some medical professionals may deliberately give their patients less effective treatments, so that they will have to keep coming back and paying more money to get their problems fixed. In a way, this is a similar phenomenon to planned obsolescence because there’s more money in treating a disease than curing it.

- Many doctors recommend freezing warts instead of rubbing a banana peel on the warts (which is extremely cheap and far more effective). This is an example of the planned obsolescence phenomenon, generalized to things beyond just products, like services.

- It’s likely that orthotropics is a better and less expensive alternative to orthodontics since it addresses the causes of malocclusions, rather than the symptoms. And yet, orthodontics remains more popular because it has compromised academia and captured most dental institutions.

- Some dentists over-treat their patients and will fill areas with fillings if they notice something that is the slightest bit off even if it doesn’t really need to be filled, since they get more money ever time they replace a cavity with a filling.

- Some birthing mothers are given C-sections, when they don’t need them, just for the sake of making money for doctors.

- Political Planned Obsolescence is when politicians don’t solve a problem once and for all, because if the problem doesn’t exist anymore, then people might/probably/will stop voting for said politicians. For as long as the problem continues to exist in some form, people are incentivized to vote for politicians who they think will do something about it (even if they actually don’t).

- Military Planned Obsolescence is when the military creates unnecessary wars for the country to fight, so that the government will have to buy more equipment, weapons, vehicles, etc from the Military Industrial Complex to fight said wars.

- Academic Research Planned Obsolescence: Dismissing the best solutions to our problems or fabricated fake ideas instead of exposing the real ideas, so that there will be an ever-lasting flow of academic research.

- Examples: Dismissing the importance of Georgism and genetic potential in understanding what really causes economic inequality, dismissing the importance of biology, race, sex, game theory, etc for understanding real-world problems, etc.

- When workers demand that their jobs not be automated or replaced with something/someone more efficient, that should be considered a form of this more generalized Planned Obsolescence that I’m thinking about, where if a more efficient solution was provided, the less efficient solutions would no longer be needed anymore.

- Consider how Milton Friedman gave the example of some shovel diggers who asked/lobbied to keep their jobs instead of getting it replaced by a much more efficient machine, and it was pointed out that giving them all spoons to dig with instead would create even more jobs, if the goal was to just create jobs.

- With this being said, the argument that laws preventing planned obsolescence would destroy jobs is a terrible argument for defending planned obsolescence. Our goal should be to produce the greatest amount of wealth possible, not to preserve jobs.

- Consider how Milton Friedman gave the example of some shovel diggers who asked/lobbied to keep their jobs instead of getting it replaced by a much more efficient machine, and it was pointed out that giving them all spoons to dig with instead would create even more jobs, if the goal was to just create jobs.

Question: Is there a better and more intuitively descriptive term that we could use to describe the general characteristic that all of these phenomena have in common, and all the different phenomena collectively as a whole?

- Constant Withholding?

- Planned Obsolescence?

- Constant Unnecessary Need?

- Constant Dependent Need?

- Inefficient Dependent Relationship?

- Manufactured Need?

- Artificially Manufactured Need?

- Inefficient Dependency?

- Manufactured Dependency?

- Dependent Relationship?

Although Apple may do a lot of things to superficially seem pro-environmental, they were actually very anti-environmental since they fully embrace planned obsolescence as a way of it increasing their profits, at the expense of consumers and the environment. Any current company that uses planned obsolescence to boost their bottom line cannot claim to be environmental just because they do things that people think are environmental.

7.3. NRT For Discouraging Planned Obsolescence

Taxing natural resources could discourage many forms of planned obsolescence, by making cheaper products that degrade the planet’s resources more expensive, so that people buy them less, vendors sell them less, and thus conserving more resources in favor of materials that are less taxing on the Earth’s resources (that may otherwise be more expensive without natural resource taxation). Planned obsolescence in phones and computers is a huge problem, considering that they require non-recyclable alloys of rare metals, which are running out. This could make the digital revolution collapse in a generation.

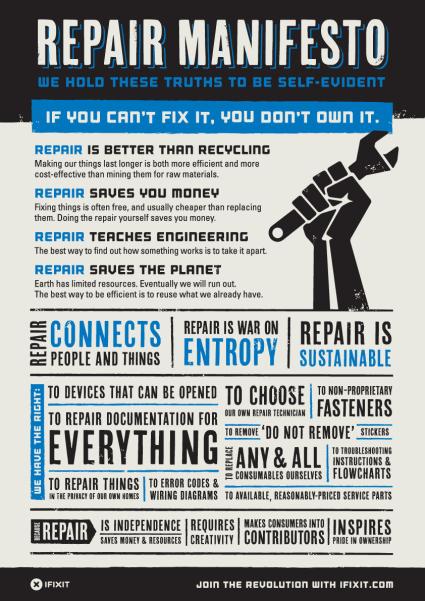

7.4. Right to Repair

The right-to-repair is enormously important for preventing planned obsolescence in many cases, and it is best guaranteed by government regulations.

Related: Only Use Old Computers – Luke Smith.

Patent reform would also help reduce Planned Obsolescence in some cases.

7.5. Political Planned Obsolescence

Political Planned Obsolescence is when politicians don’t solve a problem once and for all, because if the problem doesn’t exist anymore, then people might/probably/will stop voting for said politicians. For as long as the problem continues to exist in some form, people are incentivized to vote for politicians who they think will do something about it (even if they actually don’t).

The current electoral process for running for the US Senate or the House of Representatives makes it very expensive to live on the given salary. It causes many representatives to spend their entire terms campaigning to get reelected, lest they will not get reelected. The current electoral process incentivizes political obsolescence.

Donald Trump’s Wait-And-Promise To Pardon Ross Ulbricht

Before the end of his first term (~2020 December), Donald Trump considered pardoning Ross Ulbricht, but he chose not to.

Trump later promised to pardon Ulbricht at the Libertarian National Convention on May 2024, which incentivized many Libertarians to vote for him instead of voting for Chase Oliver.

It’s likely that the increased support from Libertarians helped Trump gain additional votes for winning swing states in the 2024 US presidential election.

While I can’t know for sure, I’m convinced that the reason why Trump chose not to pardon Ulbricht at the end of his first term was specifically so that he could incentivize Libertarians to vote for him in the future. I’m doubtful that Trump ever would’ve pardoned Ulbricht at all, if he hadn’t lost the 2020 presidential election or had managed to overturn the results in his favor. The way how Donald Trump waited until his second term to pardon Ross Ulbricht on 2025 January 21 (as opposed to pardoning Ulbricht 4-8 years earlier) is thus an example of political planned obsolescence.

7.6. Addressing Arguments In Favor Of Classic Planned Obsolescence

[I haven’t finished writing this section yet. It takes time to write stuff.]

8. My Critique of UBI

Pre-Reading: The Case Against UBI - Blithering Genius.

I agree with pretty much all of Blithering Genius’s criticisms against UBI. However, many of criticisms against UBI wouldn’t apply if UBI was funded by taxes on natural resources {(1) and (2)}. This section aims to address those arguments and talk about UBI in more depth.

8.1. LVT Would Eliminate The Need For COLAs

COLA: Cost-of-Living Adjustment

If UBI is funded without LVT, then it would have to vary depending on location, and production will plummet, among other problems. Fortunately, LVT can resolve those problems. LVT would eliminate the question whether UBI would increase rent or not. It is a proven economic theorem that Land Value Taxes cannot be passed onto the tenants. Moreover, LVT would not punish landlords for building more housing, so rents would go down if property taxes are eliminated. Likewise, if landlords don’t have to worry about increasing property taxes, then they can build as much housing as they like, which would increase and the supply of housing and further decrease rents. Land Value Taxes thus decrease the cost of rent.

Land Value Taxes would thus make housing more affordable, regardless of whether it’s a city or a rural area. The result is that the cost of living would vary less by location, if at all in many cases. This means that it won’t be necessary to provide differing UBIs depending on the recipient’s place of residence and the associated COLAs.

A friend of mine has suggested that UBI may make it easier for people who live in high-rent areas. The idea is that UBI would offer people more liquidity to move out of a high-rent area into a lower-rent area since it costs money to move from one place to another, especially if they’re living paycheck to paycheck and would have to take a few days off work in order to move all their belongings into a low-rent area. In theory, UBI would eliminate the need for them to take out a loan in order to afford to move out of their high-rent apartments and what not.

8.2. NRT Doesn’t Harm Production, Unlike Other Taxes

A UBI for say, $1000/month would have to come from somewhere, either from taxation or money printing. The person who imagined that he would be $1000 richer might find himself $1000 poorer in actual spending power.

Natural resources taxes don’t punish people for doing labor. Hence, funding UBI with NRT would reduce any decreases in production that UBI may cause. It would also make inflation unlikely, since no new money would be printed to fund the UBI.

UBI would reduce the disincentive for welfare recipients to work, but it would create a much broader disincentive to work. There are many people who would choose not to work, or choose to work less, if they received a free basic income.

This is true. Giving everyone free money would indeed reduce the incentive for all individuals to work. However, the people who choose to work less would tend to be the less productive and least hard-working people in the society, so a UBI might discourage production less than we would think.

Additionally, if a reproductive license and tax are required to have children, then society would need less welfare in general. This would leave one less thing for UBI to potentially exacerbate or fail to fix.

8.3. UBI In A World That Has Passed Peak Idea Production

Proponents of UBI claim that people would be more free to pursue creative and intellectual endeavors if they were able to work less. This ignores how we may have already surpassed Peak Idea Production. Since there is probably only a finite amount of new ideas that can be conceived in this world, it seems that UBI probably wouldn’t do much to improve society.

8.4. Possibly Better Alternatives To UBI

NOTE: In October 2024, I heard of demurrage currency for the first time, long after I wrote most of my thoughts on UBI. I will still need to think about it, but I think demurrage may plausibly be the best alternative to UBI.

If there is a surplus of government revenue after all NRT is collected, then we may need to find better ways to spend the excess revenue than UBI.

- The most basic functions of government: law enforcement, court system, military, border patrol, coast guard, foreign affairs, fire departments, emergency services, etc

- Hard infrastructure: roads, railways, bridges, tunnels, water supply, sewers, electrical grids, and telecommunications (including Internet connectivity and broadband access).

- Soft infrastructure: educational programs, official statistics, parks and recreational facilities, etc.

- K-12 Education?

- Single-Payer Healthcare?

- Singapore’s Welfare System, plus some amount of LBD?

- Laborers’ Bonus Dividend (LBD)?: Laborers who work are paid NRT by the government for working. A percentage of the worker’s salary (as determined by the government) is paid in addition to whatever the worker is paid by the employer.

- A Genius’s Basic Income?: A proposal to free our best minds from the tedium of daily life. If a minimum age is required to enter academia, then the Genius’s Basic Income could be reserved for the exceptional gifted who are exempt from having a minimum age to enter academia.

8.5. Laborers’ Bonus Dividend (LBD)

Laborer’s Bonus Dividend: Laborers who work are paid NRT by the government for working.

- This would have all the benefits of Natural Resources Tax (no land speculation, more efficient land usage, no taxation on production, affordable housing, reduced pollution, no land monopolies, reduced wealth inequality, etc),

- It also wouldn’t suffer the drawbacks of UBI (decreased incentive to work, decreased production, weakened male-female pair bond, weakened parent-child relationships, etc.

- Since workers wouldn’t pay any income taxes, they would be incentivized to work more.

- Since there would be a significantly reduced welfare state, and the NRT revenue would not be paid to people who don’t work, LBD would not subsidize people who don’t want to work at all.

- However, since workers also would receive money from the NRT-funded LBD just by the virtue of working, this might cancel out the benefits of abolishing income taxes, since workers would have to work less to make a living and save for retirement.

- People will work more if they get paid more, since getting paid more provides an increased incentive to work. However, for people doing FIRE (Financial Independence, Retire Early), most of them will only work up to a certain point once they have reached their target savings and investment. If they reach their targeted savings amount after working fewer hours under LBD instead of however many more hours that they would work without LBD, then they would work less overall.

- However, it should also be considered that earning more money for the same amount of work would enable them to live less frugally and more lavishly during the years that they are working, which would partially counter-balance the lower amount of work that they would be doing due to receiving an LBD.

- And even if LBD enables FIRE-movement laborers to retire earlier, those laborers would have to save up some additional money for the additional retirement years that they will be able to have. This would also partially counter-balance the fewer working hours made possible by LBD.

- People will work more if they get paid more, since getting paid more provides an increased incentive to work. However, for people doing FIRE (Financial Independence, Retire Early), most of them will only work up to a certain point once they have reached their target savings and investment. If they reach their targeted savings amount after working fewer hours under LBD instead of however many more hours that they would work without LBD, then they would work less overall.

- In a country where over 50% of employees live paycheck-to-paycheck, LBD would definitely increase those workers’ disposable incomes, reverse declining fertility rates, and allow the workers to retire earlier. This is far better than what we have now, and the other negative consequences of our Anti-Georgist economic system.

8.6. Maybe UBI Is Completely Unnecessary?

Head Taxes are the opposite of UBI. Head taxes require every citizen to pay the same amount of tax to the government, regardless of income. A society cannot have both a head tax and a UBI because the two would just cancel each other out. Given the potential negative effects of UBI and how head taxes help to prevent free-rider problems, it may be more practical for a society to have a head tax instead of a UBI.